As per the Asian Development Bank’s estimate, Southeast Asia will need an investment of around US$210 billion per year until 2030 to develop climate infrastructure. This figure accounts for 12% of the total estimated annual spending of US$1.8 trillion required for sustainable infrastructure in emerging economies (excluding China) until 2030, as projected by an independent panel in the 2023 G-20 meeting.

The investment encompasses various aspects such as shift away from carbon-intensive industries, boost in renewable energy, enhanced energy efficiency, preservation of forests, and promotion of sustainable land use practices. It also entails strengthening the transportation and energy infrastructure to withstand extreme weather events, cultivating crops resilient to drought, and establishing early warning systems for natural disasters.

Southeast Asia needs green infrastructure

At the root of economic prosperity in Southeast Asia lies infrastructure. However, the region is crippled by a significant annual investment deficit, exceeding US$100 billion, which calls for a substantial increase in private infrastructure investment and shift in investment focus. Having said this, the environmental impacts tied to infrastructure development, including the consumption of natural resources, air and water pollution and greenhouse gas emissions, are becoming increasingly worrisome.

Infrastructure financing to adapt to climate change in developing Indonesia

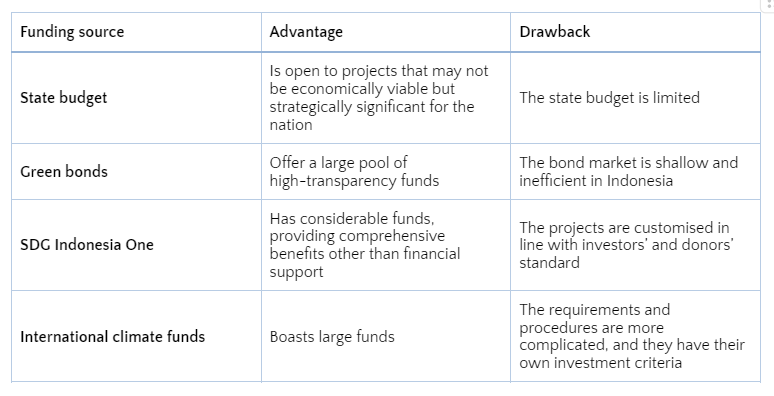

It is imperative to use innovative financing mechanisms to facilitate climate funding from diverse sources and stakeholders. For instance, government-linked and other state-owned enterprises in Indonesia should have the ability to issue green bonds to supplement the financing of green infrastructure projects, which currently rely on government budget. Besides, multilateral development banks can offer capital loss guarantees to hasten the growth of domestic green bond markets in Indonesia, as well as in other countries.

Various international bodies have presented estimates on global financing needs for climate adaptation, ranging between $28.7 billion and $90.0 billion until 2020 and between $247.2 billion and $385.2 billion until 2030, according to the Fiscal Policy Agency (2019). But there is no official data on Indonesia’s climate-related financing requirements. Indonesia’s targets, which require significant funding, depend on the objectives outlined in its Nationally Determined Contributions. The country estimates a $247.2 billion requirement to achieve its emission-reduction target.

Table 1. Advantages and disadvantages of financing options in Indonesia

Financing opportunities

The increasing global awareness on climate change has broadened the financing opportunities for climate-related projects. Indonesia can leverage the following financial opportunities:

- Green bonds: The Indonesian government has successfully established a framework for green bonds and green sukuks. Currently, three private entities – Bank Rakyat Indonesia, OCBC NISP and PT SMI have issued green bonds to fund climate change initiatives. These offerings have gained significant traction, evident in oversubscriptions, indicating strong demand for green-project financing. The country can use the green bond channel, particularly for funding climate-focused infrastructure.

- Sovereign wealth fund: The government of Indonesia has authorized the creation of the Indonesia Investment Authority (INA) – a sovereign wealth fund. INA presents a substantial opportunity given its primary focus on infrastructure development as a core mandate.

- Pension funds: Long-run investments, infrastructure projects consume time before they can generate economic value. This aligns well with pension liabilities, which have a long duration, making pension funds a potential source of financing. Indonesia also possesses significant potential for leveraging pension funds.

The recent focus on infrastructure in Indonesia has expedited the construction process, effectively addressing the long-standing infrastructure gap in the country. While this heightened infrastructure development is a positive, it remains susceptible to climate change. The country needs to integrate climate-resilient measures into its infrastructure strategies. This calls for the development of a robust policy framework. However, there exist several roadblocks to financing such infrastructure, including elevated funding requirements, investment plans that predominantly adhere to conventional approaches without factoring sustainability and diverse maturities of funding sources.