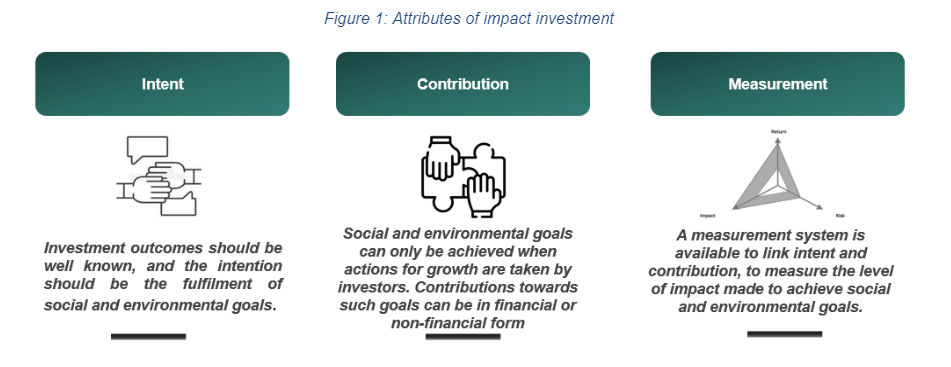

Impact investment has gained traction amid the COVID-19 pandemic, as a slew of social challenges forced institutions to change the way they invest. Consequently, companies with strong environment, social and governance practices outperformed their competitors and attracted more investment during the pandemic. Impact investments are made in public or private assets to achieve social and environmental goals. The attributes of impact investment are explained in the following chart.

Impact investments have the potential to deal with challenges, such as poverty, inclusion and climate change, and provide a fillip to sustainable development goals by 2030. However, confusion looms over the assets and strategies to consider. Therefore, some classes of investments that align with the goals of impact investment must be identified.

In private markets, impact investment covers equity and debt, real estate, infrastructure and natural resources, with most investors tilting towards infrastructure. In the public space, impact investment encompasses public equities, as well as green and social bonds. To expand the investment market, two classes of investors – private investors and development financial institutions – must converge.

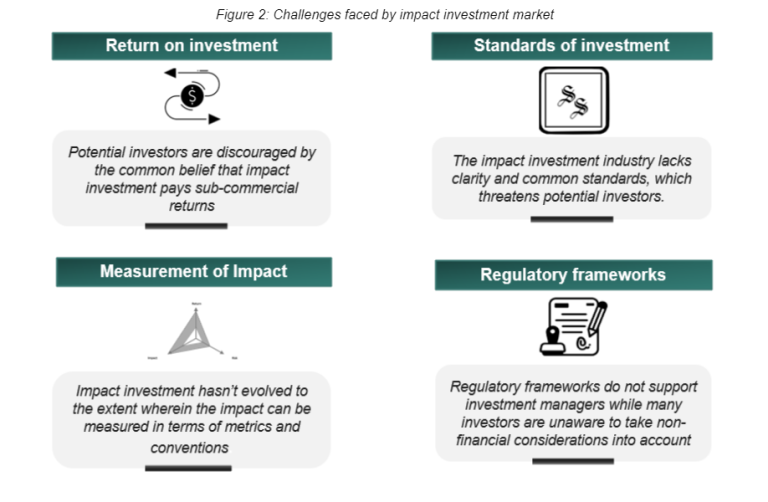

Faced with certain constraints (refer to the chart below), the impact investment market is unable to reach its fullest potential.

The challenges that stifle the growth of the impact investment industry need to be tackled through the identification of key solutions. First, one needs to bring clarity and discipline to the management of investments and integrate impact considerations with financial objectives, understanding the key elements in the investment process. In other words, investors need to follow the principles of the investment process to ratchet up transparency in fund management.

Second, uniform standards, which will help compare the efficacy of impact strategies, must be adopted to increase impact investments’ comparability and transparency – two metrics whose demand has been buoyed by the growth of the impact industry to assess the positive and negative impact of investment decisions.

Third, regulatory and policy revisions will allow investors to include impact considerations in reporting. To exploit the full potential of the impact investment market, synergies need to be created between development financial institutions and private impact investors.

Investors adopt a plethora of investment strategies to make an impact in private and public markets. Investments whose impact is measurable and visible are mostly those made in private markets, while evidence of a quantifiable impact of individual investors in public markets is limited. However, material capital can be invested in public assets, including green and sustainability bonds. With the passage of time, even public markets have realised the weight of intention and evidence, so they are increasing transparency through impact reports and narrowing the transparency gap between public and private markets.

Thus, to conclude Impact investment will keep on increasing considering growing environmental concerns. However, investors need to analyse the impacts of their investments through detailed analysis and matrices. To avoid investment challenges, project impacts need to be integrated with financial objectives, so that financial institutes and impact investors can collaborate together towards a common agenda.