The 2015 Paris Agreement culminated in a global goal to contain global warming to lower than 2°C (ideally to 1.5°C). An international alliance of pioneers from the energy sector – the Energy Transitions Commission (ETC) – has announced that the global carbon footprint must be pared by at least 40% by 2030 (compared to 2022) to attain net zero by 2050 and limit global warming to 1.5°C. Considering the increasing release of greenhouse gases into the atmosphere, countries will find it challenging to pool the funds required for mitigating the risks tied to rising global temperature and other natural calamities. Global warming will likely have a substantial impact on the economies and communities around the world. Therefore, many nations and businesses are dedicating efforts towards achieving net zero by the middle of this century. This is not possible without addressing alarming signs and prudently managing financial flow in the global economy.

Economic guidelines and steps taken by the financial industry play a pivotal role in energy transition. They, however, vary by nation (high-income, middle-income, and low-income), depending on their relative capacity in mobilizing finances. There are two main channels through which financial players circulate money in an economy – capital investments and grants and concessions.

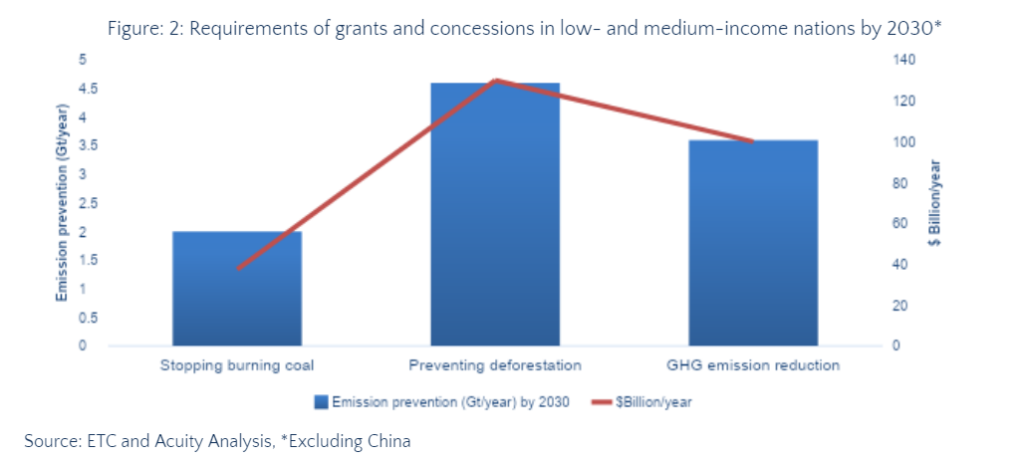

Grants and concessions: Grants and concessional payments are offered as incentives to key players of an economy to encourage them to adopt measures for which they lack financial motivation such as payoff or profit. These payments support the decarbonisation efforts of low- and medium-income economies by helping them achieve their three main goals: forest conservation, closure of coal stations and elimination of greenhouse gases from the environment. By 2030, around $300 billion of concessional payments and grants are required for the achievement of the above-mentioned objectives. Such financial aid is expected through emission trading, charitable contributions and intergovernmental advancements.

Currently, adequate cash is available worldwide to finance the necessary investments, but nations with lower incomes are unable to afford these finances. When considering the anticipated reduction in fossil fuel investments over the coming 30 years, a mean total investment of $3 trillion annually in energy transition corresponds to approximately 1.3% of the forecast worldwide GDP. Even though there was no necessity to create a carbon-free economy, around one-third of the $3 trillion will be needed for economic development and diversification of the power industry in low-income nations. The correct allocation and use of capital investments and grants & and concessions would not only support the growth of a country but also turn out as efficient resources in making Earth a carbon-free planet.