The unprecedented COVID-19 pandemic derailed the global economy in 2020-2021. This crisis also affected The Association of Southeast Asian Nations (ASEAN’s) prolonged efforts towards economic growth. ASEAN leaders adopted the ASEAN Comprehensive Recovery Framework (ACRF) in 2020 as part of a streamlined and coordinated strategy to tackle the crisis. Sustainability is a fundamental theme across the ACRF’s aims, activities and programmes. The ACRF recognises that well-managed and well-implemented long-term sustainable investments will likely strengthen economic and social resilience to future shocks.

ASEAN has several structural advantages that provide expansion opportunities and value investors. As the region’s recovery efforts from the harmful effects of the COVID-19 pandemic gain traction, financial institutions looking for distinctive opportunities can add alpha to their strategies by leveraging ASEAN’s diversified markets.

ASEAN nations are pushing for sustainability. Given that ASEAN cities are among the most vulnerable to the effects of climate change, the European Union plans to contribute EUR 5.1 million to the Smart Green ASEAN Cities program over 2021-2025. This emphasis on sustainability is expected to provide significant opportunities in several industries, including decarbonization, decentralized and grid-based renewable energy for industries, energy transition, clean transportation and green buildings. Figure 1 shows a 2X increase in renewable energy capacity across ASEAN.

Source: DDQ Invest

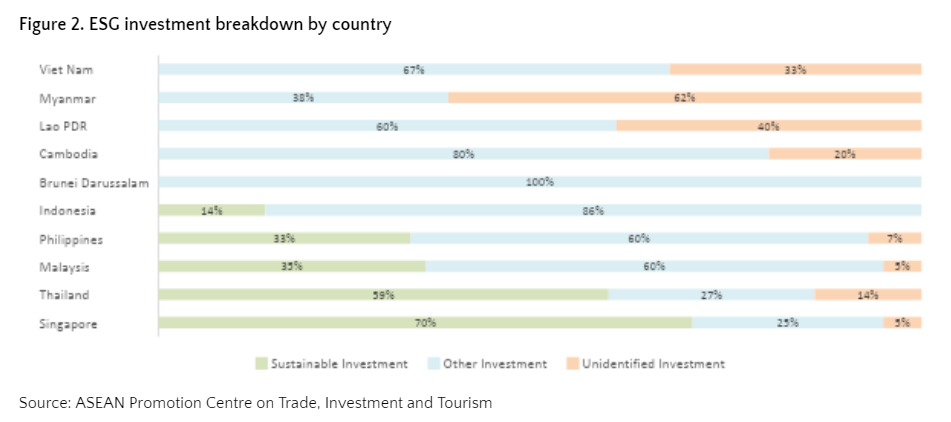

The adoption of environmental, social and governance (ESG) investing and Sustainability Development Goals (SDG)-related strategies are gaining traction in ASEAN. ASEAN-5 (Thailand, the Philippines, Indonesia, Singapore and Malaysia) has seen a positive trend in ESG investment. However, the other member states need to put in more effort to catch up with ASEAN-5 (see figure 2).

Figure 3 depicts the share of ESG enterprises by industry. ESG companies are mostly found in the food, beverages and tobacco; industrial machinery and transportation industries.

ESG investments boost the profitability of businesses by lowering costs and increasing revenue. ESG businesses have a greater average net profit margin than non-ESG businesses. According to ASEAN-Japan Centre, the average profit margin of ESG businesses is 11.41% (vs non-ESG businesses’ 9.61%). This lower profitability is due to higher risk, which causes income to fluctuate over time.

Gunung Capital’s distinct investing approach helps businesses build value by focusing on hands-on operational performance, disciplined and efficient capital management, and end-to-end integrated solutions that prioritize ESG and SDG activities.