Given the current circumstances of the increasing effects of climate change, achieving a successful energy transition will require significant, decisive measures. We understand that most of the energy transition is based on renewable energy sources. Therefore, investments and comprehensive policies must be devised globally. IRENA (International Renewable Energy Agency) has conducted an analysis of the investment needs for the global energy transition under its report World Energy Transitions Outlook, 2023. In this report, IRENA presented two energy scenarios for the investment to accelerate the energy transition.

- Scenario-1: Planned energy scenario– This scenario offers an outlook on changes in the energy system based on government energy plans and other planned targets and policies in existence at the time of analysis, with an emphasis on G20 nations.

- Scenario-2: 1.5°C Scenario The 1.5°C Scenario describes an energy transition pathway aligned with the 1.5°C climate goal to limit global average temperature increase by the end of the present century to 1.5°C, relative to preindustrial levels.

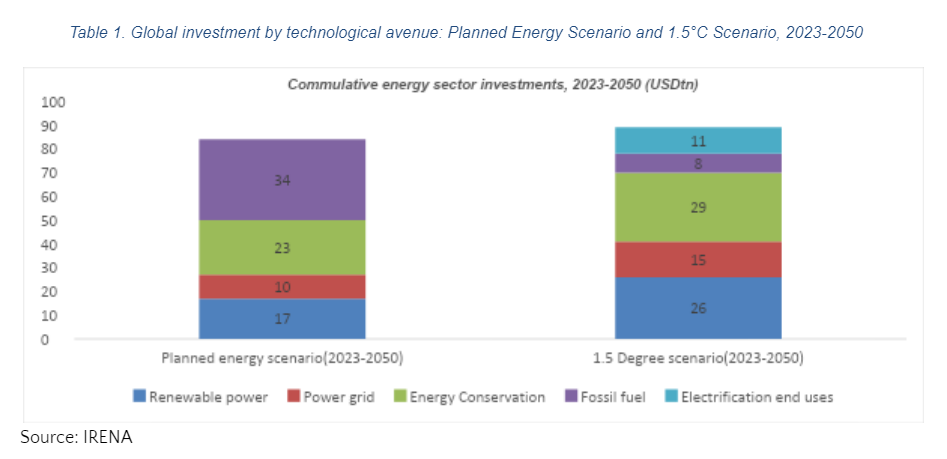

As per the IRENA, the Planned Energy Scenario estimates a cumulative investment of USD103 tn. is required from all sectors from 2023 to 2050. About 60% of this would go towards transitional technologies, primarily in the renewable energy sector, to ensure efficiency, electricity and hydrogen production, and carbon dioxide removal. However, 40% of the expected investment would still go towards fossil fuels. Investment in transition technologies must be scaled up and redirected to keep the 1.5°C target within reach. This calls for an increase in capital spending of USD 47 tn. over the Planned Energy Scenario, to reach a total of USD150 tn., and a redirection of approximately USD 26 tn. from coal- and oil-based fossil fuel technologies towards transition technologies and infrastructure over the period.

Investment in energy transition technologies reached a high of USD1.3 bn. in 2022 but was still insufficient to meet the 1.5°C objective. More investment is needed to implement policies and initiatives and develop regional capacities (such as training) to accelerate the energy transition. Investment so far has been concentrated in a few nations, making it impossible to meet the 1.5°C target. For the energy transition to be global, the availability of funding needs to increase. It is also necessary to define risk in relation to investing in energy assets more thoroughly. The narrow focus on risk to investors’ returns must be broadened to include the dangers to society and the environment. The international community would need to act now since the developing world has inadequate public funding.

The 1.5°C Scenario calls for an investment of USD150 tn. in infrastructure and transition technologies by 2050; this translates into USD 5.3 tn. on average, annually. This is an increase of USD 1.7 tn. annually over the Planned Energy Scenario. Investment in transition technologies in end-use sectors would make up USD 73 tn., or around 47% of the total investment needed by 2050. This comprises an expenditure of USD 43 tn. on efficiency and conservation, USD 16.6 tn. on electrification, USD 6 tn. on the development and use of renewable technology directly, USD 4.7 tn. on green hydrogen and USD 3 tn. on carbon abatement.

A cumulative investment of USD 61 tn. would be required in the 1.5°C Scenario to build the capacity for renewable power generation (USD 39 tn.) and support infrastructure for renewables, such as power grids and flexibility (USD 22 tn.). Investment in the supply of fossil fuels would total USD12tn, while investment in the production of fossil fuels and nuclear power would total USD 1.9 tn. and USD 1.6 tn., respectively.

The Planned Energy Scenario’s approximately USD1tn yearly investment, on average, in coal- and oil-based fossil fuel technologies would be switched to transitional technologies and infrastructure in the 1.5°C Scenario. Over USD26tn of investment would have been misdirected until 2050.

Investment opportunities by sector and technology

A record-breaking USD1.3 tn. was invested globally in transition technologies in 2022. To stay on the path to 1.5°C, though, the annual expenditure would need to increase by more than three times this amount. Table 1 examines the annual investment needed by sector and technology to achieve the 1.5°C Scenario, and the following section provides greater detail on precise investment requirements.

Both these scenarios would require an increase in investment in the electricity sector – in additional renewable energy generation capacity, grid extension and resilience, and other grid flexibility measures (due to improved renewable energy generation), including stationary battery storage and demand-side flexibility. Average yearly investment in renewable power production capacity, power grids and flexibility is expected at more than USD 1 tn. until 2050 in the Planned Energy Scenario.

The electricity sector would need to be transformed with an average investment of more than USD2.2tn per year through 2050, according to the International Renewable Energy Agency’s (IRENA’s) 1.5°C Scenario. A total of USD61tn would be required; this is more than twice the total expenditure needed to get to 2050 under the Planned Energy Scenario (USD28.5tn). The increased investment is required due to widespread electrification, the production of green hydrogen and higher initial capital expenditure required for renewable capacity (relative to fossil fuels) and flexibility measures.

Most of the investment would go towards renewable energy technologies such as solar and wind. Annual average investment in solar PV (rooftop and utility-scale) is estimated at USD333bn from 2023 to 2050, annual average investment in onshore wind at USD356bn and annual average investment in offshore wind at USD283bn. There would need to be an increase in investment of 2.6 times per year in solar PV, 3.75 times per year in onshore wind, and 5 times per year in offshore wind over-investment in 2021.

Deployment levels would need to increase from over 3,000 gigawatts (GW) today to over 10,000 GW in 2030, or an average of 1,000 GW yearly, to maintain 1.5°C. Deployment is currently restricted to specific geographies; two-thirds of all additions last year were made by China, the European Union and the United States, with developing countries lagging behind. To facilitate the transition and reduce the risk of stranded assets, any new investment decision should be carefully evaluated. 41% of planned investment is still expected to go towards fossil fuels by 2050. To keep the 1.5°C target within reach, almost USD 1 tn. of annual fossil fuel expenditure scheduled by 2030 would need to be shifted towards transitional technologies and infrastructure. Investment would also need to be made in a more equal manner, with action from the public sector. Less than 50% of the world’s population benefited from 85% of the world’s investment in renewable energy in 2022.